Alright, it’s the startup era. It is no longer embarrassing to call yourself an entrepreneur. Aren’t we glad the 90s are a thing of the past? Now you can drop out of school, determined to make it on your own and the world won’t judge you. Millennials everywhere are motivated by silicon valley and we all want to be the creators of the next unicorn ( I just realized that will need to be word number one). So, as a budding entrepreneur you will be reading, watching and listening to a lot of startup content and words will fly around. Thinking about that I just thought it would be good to have a short crash course into some startup terms that can help you understand better or sound like the smartest entrepreneur in the room.

1. Unicorns

Startups that have been valued at more than $1 billion such as Instagram, Evernote, and Shazam. Although in reality, unicorns are beyond the startup stage.

Decacorns These are the ‘big boys’ – the companies valued at over $10 Billion. Notable members of the ‘club’ include Uber, WhatsApp, and Snapchat.

So next time you are trying to show just how ambitious you are going with your startup, throwing in Unicorn could save you a lot more time than “we would like to become a billion-dollar business.” In any case, unicorns are rare, yes we’ve seen more in business than in real life, but be careful before you declare unicorn status.

2. Disrupt/disruptive

When a startup sets out to revolutionize its sector or industry. Something that completely changes the way society does something (e.g. Uber/Lyft vs. Taxis or Amazon vs. in-store shopping).

“The selling of a cheaper, poorer-quality product that initially reaches less profitable customers but eventually takes over and devours an entire industry.” – from 1997’sThe Innovator’s Dilemma, by Clayton M. Christensen. Disruptive has since become a way to describe a product or technology that will change its marketplace.

If you have a business idea and the list of existing businesses that would love to see you shut down before you even start has more than one company then you most likely have something disruptive on your hands. Also key to note is that when it’s disruptive it may also mean your target market may need some educating. Get ready to dig in!

3. Angel investor

An individual who invests his or her own money at an early stage in exchange for a share of the company. An angel can be a high net worth entrepreneur or friend or family member willing to invest in a great idea. Angel investors tend to invest fewer dollars than venture capitalists, although some form angel groups to invest in bigger business opportunities.

Venture capitalist (VC)

A professional individual who invests money in businesses in exchange for an equity share of the company. Because VCs and venture capital firms invest institutional dollars (for investors, funds, and pension plans, etc.), they usually focus on proven or later-stage startups and invest greater amounts of money (typically at least $2 million per round).

4. USP

Stands for Unique Selling Proposition. This refers to the unique factor of your company or product that sets you apart from all your competition. It’s the answer to the question, “Why should I do business with you instead of anyone else?”

Example: M&M’s “Melts in your mouth, not in your hand.” M&Ms use a patented hard sugar coating that keeps the chocolate from melting in your hands.

5. Cottage Business/ Cottage Industry

A nice business but not something massively scalable. If you have one, you’re not a good fit for VC, but this does not mean you should not pursue your dream or that you will not be very successful!

I personally don’t believe VCs aren’t the key to success, at least not VCs that you approach. A truly genius and disruptive startup will recruit VCs without you trying. Do not let someone else’s standards of success define whether you go for it or not.

6. (FMA) First Mover Advantage

Not every start-up is the first to market, but if you are, you want to point that out to investors. Be aware that this can be both a pro and con, as you may have to educate your market as you go, so the sales you make will cost more than they would in a market with clearly established demand.

While some investors are into this jive and it is really a nice thing to be able to say when you pitch, don’t let it get you cocky. Make sure you have a very good product. People buy products, not whether or not you were the first to come up with the idea.

7. A nondisclosure agreement (NDA)

A legal document that protects a startup’s secrets by holding employees responsible to pay damages for leaking them. NDAs can be used to protect things like proprietary code, formulas, or customer information. You can have a “one party” NDA where one side is receiving confidential information from the other, or a mutual NDA for both parties.

I remember staying up for several nights drafting an NDA for the startup that we started together with my best friend and two other close friends. It was very important as we had decided to disrupt the music industry in Zimbabwe with an app called Olova Music. We had meetings with artists, producers and companies every other day of the week. Though I don’t know if I had drafted the NDA well enough to thoroughly stick in a court of law, it definitely covered the basics and kept us safe for at least a year.

8. Bootstrapping

When the company founder is having to rely on savings and money from friends and family to grow the business in its very early stages.

Boot-Strapping is also using “friends and family” cash to get going. As Carey Martell, Founder of Power Up TV put it, “Boot-strapping a startup means ramen noodle days. Every time you want to splurge on something you think, ‘Well I could have that $20 steak dinner, or I could hire a virtual assistant from the Philippines.’

For us, boot-strapping meant a lot of coffee meetings where we hoped and prayed that the people we were meeting wouldn’t order more than just the coffee we had planned. This one time, we were spoiled to a meal though. A very good change from the ramen life.

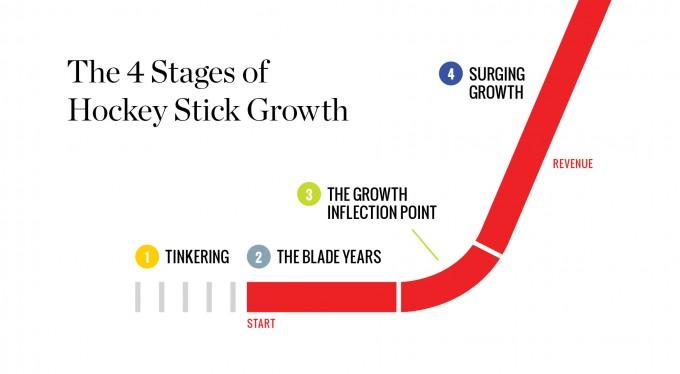

9. Hockey stick

When a startup experiences steady growth and then a sudden rise so that on a graph it looks a bit like a hockey stick. So Forbes describes it below, but you know how Millennials are impatient right? so the Blade years is probably the Blade days. Read more here.

10. MVP

This is Minimum Viable Product. It’s the service or product that has the highest return on investment versus the risk/effort involved.

in other words, it’s the product at the absolute minimum you need for it to start servicing your target market without breaking and destroying the brand or any goodwill before you go too far.

There are a lot of words used in the startup world. This may just become a mini-series where we can discover more of these words together and improve. The goal is to continuously Improve. #kaizenYOU

Source (I forgot the other ones)

https://fleximize.com/articles/004165/guide-to-20-popular-startup-jargon-words

[…] I did a similar article on startup terms last year and it seemed to be something that interested a lot of people. I then realised that we […]

LikeLike

[…] Read 10 Startups terms you should know. […]

LikeLike

[…] The key in terms of costs comes down to how big a target you want to target and how fast you want to grow. If you are willing to take your time proving the concept to a small group and growing that group you can actually grow at a rate that doesn’t balloon your costs ahead of your revenues quickly while chasing Unicorn status […]

LikeLike

[…] The key in terms of costs comes down to target size and desired growth rate. If you are willing to take your time proving the concept to a small group it’s better. You can grow at a rate that doesn’t balloon your costs ahead of your revenues quickly while chasing Unicorn status […]

LikeLike

[…] I did a similar article on startup terms last year and it seemed to be something that interested a lot of people. I then realised that we […]

LikeLike